5 Reasons College Students Should Start Building Credit ASAP

If you’re a college student, you’ve definitely heard someone say that these will be “the best years of your life”. But if it feels like they are also the busiest and most stressful, you’re not alone. There are a lot of responsibilities on your plate (and distractions), but don’t let those four years fly by without building good credit.

Your credit score is a number that indicates how responsible a borrower you are. It's used by lenders, landlords, a few HR departments to determine how high your interest rates on loans are, whether or not you need a cosigner on your apartment, if you qualify for that particular job and more. You’ll want a start building credit history during college alongside your hard-earned resume and diploma.

Your credit score is a number that indicates how responsible a borrower you are. It's used by lenders, landlords, a few HR departments to determine how high your interest rates on loans are, whether or not you need a cosigner on your apartment, if you qualify for that particular job and more. You’ll want a start building credit history during college alongside your hard-earned resume and diploma.

1. Time is Money – Get Started ASAP.

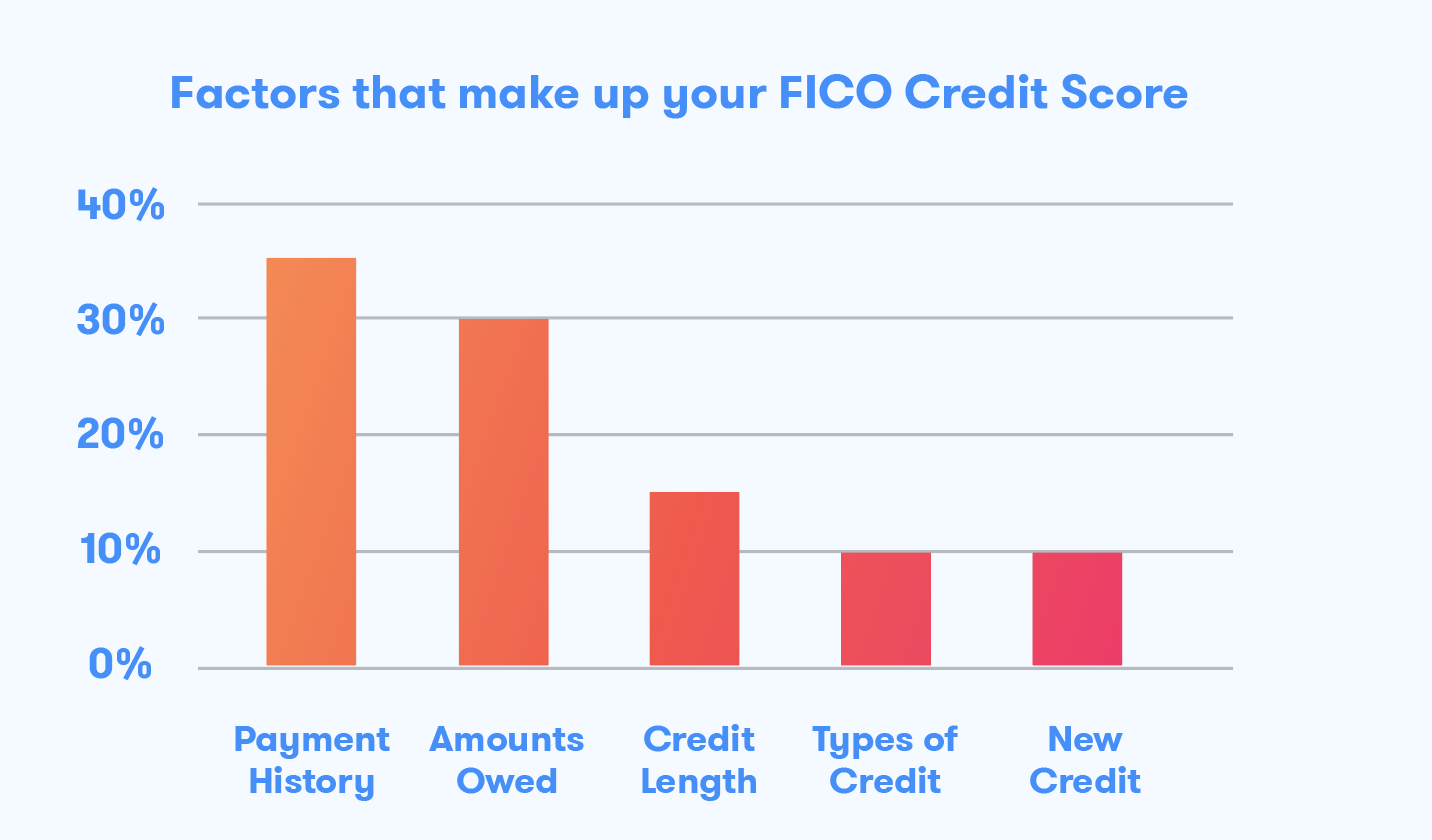

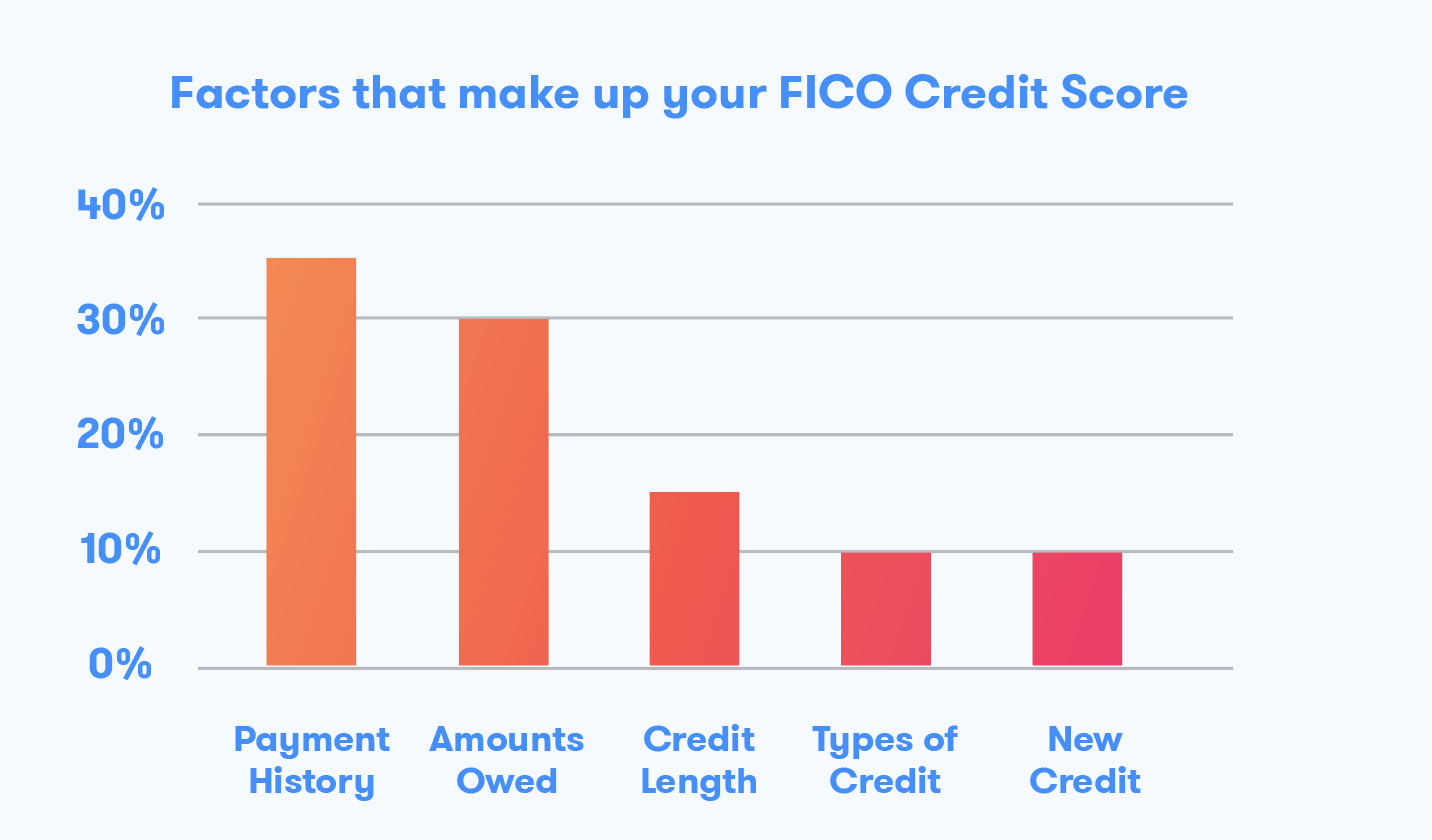

What do you need to get a credit score? The largest portion of the score, approximately 35%, is based on payment history. Payment history refers to consistent and timely payments on things like credit cards, loans, utilities, and more. Plus, the length of the payment history alone counts for an additional 15% of your score. Open a line of credit and start making payments ASAP to start building a long and healthy credit history.

2. Diversity is Key – Mix It Up!

Most college students know how important diversity is when it comes to education, the workplace, life, etc. (cheers on being woke, Gen Z). Did you know that diversity also enhances your credit score? In fact, your credit mix makes up about 10% of your credit score and new credit makes up another 10%. For example, you might have a credit card, student loans, and a KoraCash loan. Be careful, though, because it’s not ideal to open too many lines of credit at once. Having several new accounts isn’t a good look, and it lowers your average account age. Get started during college to that you can slowly build your credit mix.

3. Keep Moving Forward – Take the Next Steps.

After working so hard in college to achieve your goals, don’t let a lousy credit score hold you back when it’s time to start adulting (especially if one of your goals is say goodbye to your crowded campus apartment and hello to one with in-unit laundry). New opportunities and challenges pop up pretty quickly after graduation, and a good credit score will make living your best life so much easier (and frankly, possible). Think even further down the road – you’ll be thanking your college self when it comes time to buy those rustic mansions and designer weddings on your Pinterest boards.

4. Be Prepared – You Might Need More Loans.If student loans are funding your education, it’s hard to even think about the possibility of more loans in the future. But as they say, sh*t happens. If you ever need a loan down the road for a wedding, medical expenses, etc., you’ll want the best credit score possible to get approved and qualify for a decent interest rate.

5. Reach the Finish Line – Land Your Dream Job.Between the time spent making friends and tailgating, hopefully you’re squeezing in some resume building and networking. If you’re already putting in the work on LinkedIn and at your internship, you can impress your future employer with even more than your sparkling resume and transcript. Your credit score could also be an important component of landing a job (which was the whole point of college, anyway, right?).

We covered most of the main components of your credit score: payment history, length of credit history, new credit, and credit mix. One more thing – don’t forget to actually use your credit! Credit utilization makes up 30% of your score. If you open up a credit card or get KoraCash in college, buy an interview outfit or pay some bills, and make your payments on time…you’re off to an amazing start!